Sales Return

There are 2 ways of adding sales return

First way:

Edit existing invoice for the sales by going to edit the invoice and remove the product or reduce the quantity of the product. And save it. The system will automatically add the returned quantity back to stock. This is a simple & recommended way of doing.

Second Way:

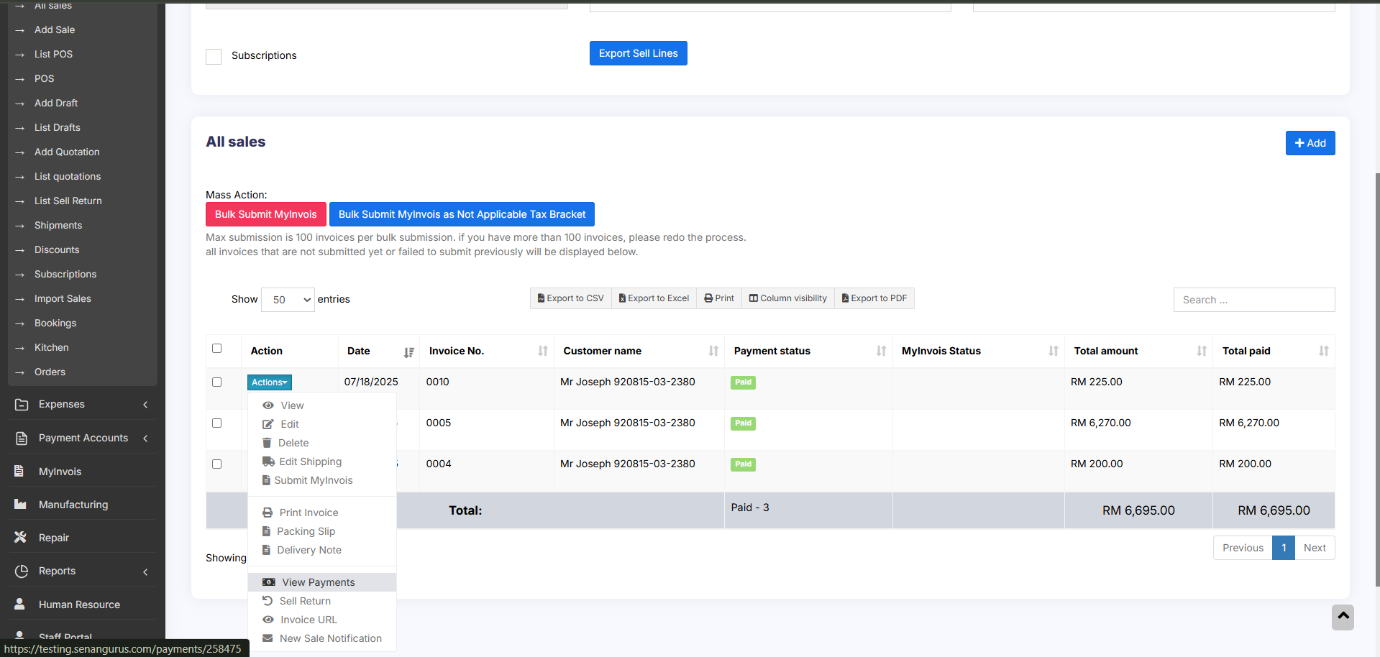

Follow the screenshot below:

Payment for Sale Return:

When a Sale Return is created, the system considers the return amount as a Due Payment, indicating that the amount needs to be refunded to the customer.

To complete the return process, you must add a payment to record the refund.

To add the payment for sale return, follow the steps.

-

Go to Sales → List Sale Return.

-

In the list, locate the Payment Status column for each sale return entry.

-

If the status shows Due, click on the Due button.

-

This will open an Add Payment pop-up window.

-

-

Enter the Refund Amount and click Save.

-

The Payment Status will now update to Paid.

Question: Why sell return value not decrease the payment value from the parent invoice?

- SenangUrus Business will adjust these values in the Profit & Loss report.

- Regarding payment, users have to add a transaction for receiving payment from the customer and then paying them back. This way all the transactions are recorded.

No comments to display

No comments to display